Hello @TaxWiser

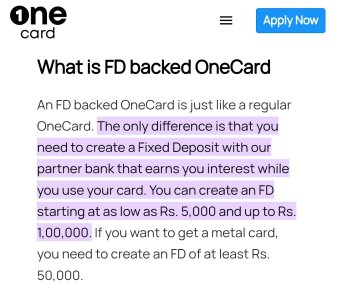

I have just turned 18 years and planing to make a FD (in HDFC) with such a good amount (I opted for FD because I can't take risk here, so please no judgment on this ). And thereafter against that FD I'm sure I will get a Credit Card against it for a limit of ₹6 lakhs+.

). And thereafter against that FD I'm sure I will get a Credit Card against it for a limit of ₹6 lakhs+.

But I have some doubts to solve, please help me.

1. According to many youtube videos and online article I got that I can get a CC against my FD for the 90% limit of my current FD, but I have a question that limit is monthly, quatarly or yearly ?

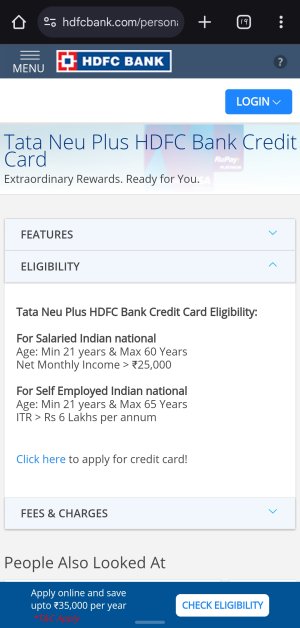

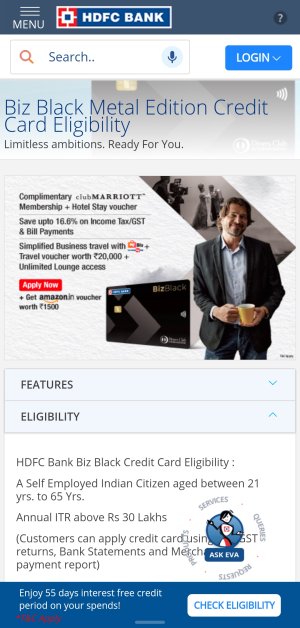

2. Also from many source above mentioned I also got many suggestions for a secured CC but as a student I want a Lifetime free CC for me, so if there is any suggestion for me please say to me (considered that my FD will be in HDFC).

3. Can I pay my semester fees using this CC ?

4. If the FD is opted for monthly interest payout am I still eligible for the CC ?

And any further suggestions from you and all of the community members @zacobite @anuragmukherjee28 @ShavirB @nikhilchauhan @Sam Maxi @Skylar please say to me.

I have just turned 18 years and planing to make a FD (in HDFC) with such a good amount (I opted for FD because I can't take risk here, so please no judgment on this

But I have some doubts to solve, please help me.

1. According to many youtube videos and online article I got that I can get a CC against my FD for the 90% limit of my current FD, but I have a question that limit is monthly, quatarly or yearly ?

2. Also from many source above mentioned I also got many suggestions for a secured CC but as a student I want a Lifetime free CC for me, so if there is any suggestion for me please say to me (considered that my FD will be in HDFC).

3. Can I pay my semester fees using this CC ?

4. If the FD is opted for monthly interest payout am I still eligible for the CC ?

And any further suggestions from you and all of the community members @zacobite @anuragmukherjee28 @ShavirB @nikhilchauhan @Sam Maxi @Skylar please say to me.

Last edited: