tanbir2001

KF Rookie

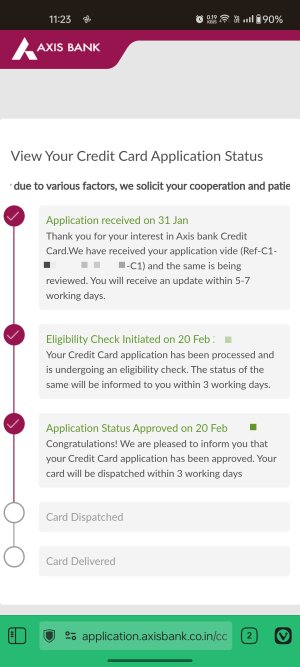

My mother had applied for a credit card on 31st Jan 2024 with Axis Bank. She had completed her eKYC. After that on the website the application status was not available. We thought axis bank had rejected the application. Meanwhile we changed our mind about the card due to many frauds being reported nowadays and she doesn't know well about using credit cards.But Yesterday on 21st Feb she received an sms that her Axis Bank Neo Credit card is approved and will be dispatched soon. She doesn't want the card now as she fears she won't able to handle it. Will the card and credit account be closed or will there be any charges or Annual fees if she doesn't Activate the card at all after delivery?

Also kindly give me suggestion on what better options I have?

Also kindly give me suggestion on what better options I have?

Attachments

Last edited: