You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IDFC First Bank Credit Card

- Thread starter Neeraj920

- Start date

Skylar

KF Master

IDFC has the worst application prosses.Hi

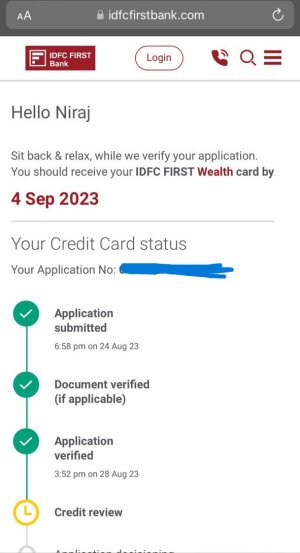

Can anybody advise, what could be the reason for declination of credit card after this much of steps? During the application they had mentioned that I will receive Wealth Credit card with limit more than 6 Lakh. This happened twice with me. First time I had applied in Dec 2022.

View attachment 945

Have you asked IDFC reason for rejection?

Yes, but they did not give proper response. They told me that you have very good credit score and history, but they are unable to give reason for decline. They asked me to apply again after 6 months.IDFC has the worst application prosses.

Have you asked IDFC reason for rejection?

Skylar

KF Master

Your overall credit vs annual income?Yes, but they did not give proper response. They told me that you have very good credit score and history, but they are unable to give reason for decline. They asked me to apply again after 6 months.

Do you mean credit score or credit limit for any other card? They were offering 6.38 lakh credit limit during application.Your overall credit vs annual income?

Skylar

KF Master

Na, your overall credit limit of all cards combined vs annual income.Do you mean credit score or credit limit for any other card? They were offering 6.38 lakh credit limit during application.

Skylar

KF Master

See, if my annual income is 5lac

and my credit limit of my 4 cards is 6lac

Then I'm overleveraged. as my credit is more than my income.

This reason is most common once SBI would give, but other banks won't tell cause their stupid systems have no option to show reason for rejection in their system.

and my credit limit of my 4 cards is 6lac

Then I'm overleveraged. as my credit is more than my income.

This reason is most common once SBI would give, but other banks won't tell cause their stupid systems have no option to show reason for rejection in their system.

My annual income is approximately 15 lakh and other bank cards like HDFC (4.7 lakh), AXIS (5.7 lakh), ICICI (5.7 lakh), SBI -4.21 lakh. I generally use less than 10% of credit limit.See, if my annual income is 5lac

and my credit limit of my 4 cards is 6lac

Then I'm overleveraged. as my credit is more than my income.

This reason is most common once SBI would give, but other banks won't tell cause their stupid systems have no option to show reason for rejection in their system.

Skylar

KF Master

4.7+5.7+5.7+4.21= 20.31My annual income is approximately 15 lakh and other bank cards like HDFC (4.7 lakh), AXIS (5.7 lakh), ICICI (5.7 lakh), SBI -4.21 lakh

So, here we go - Overleveraged - This could be the potential reason for rejection.

Because this one have lounge and other premium benefits. Now I am considering to apply Federal Bank celesta & AU Ixigo (LTF) along with IDFC. Please advise which one should I proceed and have higher chances of getting approval. I have home loan with outstanding principal amount 19 Lakh. Last time during the same duration, I got Indusind legend card approval with limit 5 lakh but IDFC got declined.May I know why you want IDFC Wealth card?

Skylar

KF Master

What are your other cards from AXIS, HDFC and ICICIBecause this one have lounge and other premium benefits. Now I am considering to apply Federal Bank celesta & AU Ixigo (LTF) along with IDFC. Please advise which one should I proceed and have higher chances of getting approval. I have home loan with outstanding principal amount 19 Lakh. Last time during the same duration, I got Indusind legend card approval with limit 5 lakh but IDFC got declined.

- IDFC Wealth had premium benefits but a couple of months back it goes devalued you might have watched old videos of IDFC wealth, that card is not worth the hassle anymore.

- AU Ixigo - again the worst bank devaluation on it happens frequently and soon it will be a useless card.

- Federal Bank, I'm not at all familiar with it.

AXIS - Flipkart & My Zone, HDFC - Tata Neu Infinity & Regalia, ICICI - Amazon Pay & Coral Rupay,What are your other cards from AXIS, HDFC and ICICI

- IDFC Wealth had premium benefits but a couple of months back it goes devalued you might have watched old videos of IDFC wealth, that card is not worth the hassle anymore.

- AU Ixigo - again the worst bank devaluation on it happens frequently and soon it will be a useless card.

- Federal Bank, I'm not at all familiar with it.

Please suggest some good cards with LTF benefits

Skylar

KF Master

Bro with your salary LTF cards is worse their return is worse.AXIS - Flipkart & My Zone, HDFC - Tata Neu Infinity & Regalia, ICICI - Amazon Pay & Coral Rupay,

Please suggest some good cards with LTF benefits

Bro, I want you to check this channel

"Credit Cards Sahi Hai" some 700 subs see cards they are using.

In Axis, HDFC and ICIC alone you can get the best cards.

Federal bank Celesta card, though they say its their top premium card but the features are very basic. But its good to have if you still want it as I believe they are offering it as a LTF now. I had this card as a LTF for over an year but never used it and closed it a couple of months ago.Because this one have lounge and other premium benefits. Now I am considering to apply Federal Bank celesta & AU Ixigo (LTF) along with IDFC. Please advise which one should I proceed and have higher chances of getting approval. I have home loan with outstanding principal amount 19 Lakh. Last time during the same duration, I got Indusind legend card approval with limit 5 lakh but IDFC got declined.

Similar threads

- Replies

- 7

- Views

- 235