anuragmukherjee28

Moderator

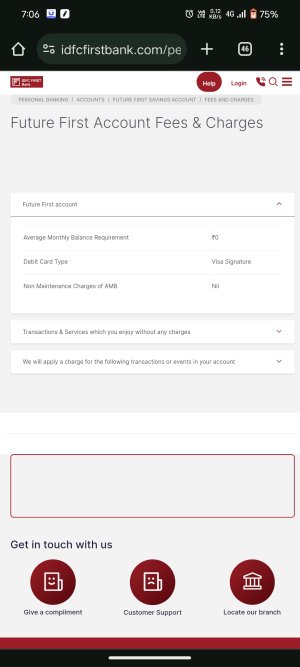

there is no maximum balance limit ,this is the interest rate that you will get in your saving accounts and from here you can so that there is no maximum balance limit.What is the maximum balance limit on pratham savings account

- Up to Rs 1 lakh: 3% per annum

- More than Rs 1 lakh but less than Rs 5 lakh: 4% per annum

- More than Rs 5 lakh but less than Rs 50 crore: 7% per annum

- More than Rs 50 crore but less than Rs 100 crore: 5% per annum