Abhi7hek

KF Rookie

Recently, I got a RuPay-based credit card. Earlier, I used to pay for utility bills and some online purchases through Amazon Pay Later.

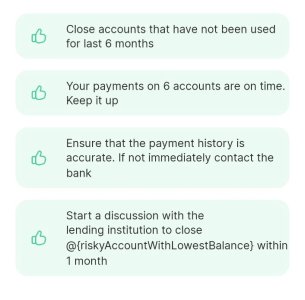

In the OneScore application, I received a prompt suggesting that I close risky accounts with the lowest balance, i.e., Amazon Pay Later, to improve my credit score.

I also have two ongoing monthly EMI payments for personal loans.

One gold loan and 3 consumer loan i.e, amazon paylater (axio and karur Vysya bank), flipkart paylater.

To improve my credit score

Should I close it or leave it as it is?

Current scores :

CIBIL- 757 Experian- 755 Equifax -762

CRIF - 718

In the OneScore application, I received a prompt suggesting that I close risky accounts with the lowest balance, i.e., Amazon Pay Later, to improve my credit score.

I also have two ongoing monthly EMI payments for personal loans.

One gold loan and 3 consumer loan i.e, amazon paylater (axio and karur Vysya bank), flipkart paylater.

To improve my credit score

Should I close it or leave it as it is?

Current scores :

CIBIL- 757 Experian- 755 Equifax -762

CRIF - 718