Hanush Kumar

KF Expert

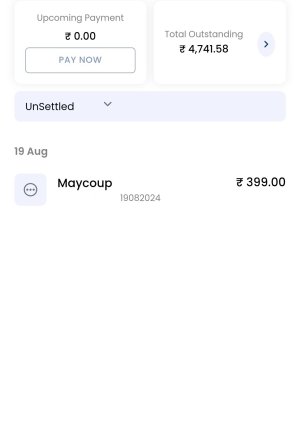

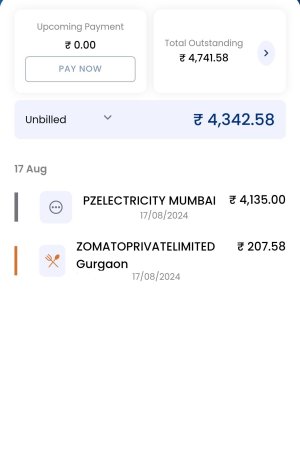

I purchased a gift using my hdfc iocl card on an online shop. The order is confirmed and I received the order id also. Similarly, I got the transaction details also. But in the my cards app, the amount (399) I spent on the gift is categorized as unsettled. I made some earlier purchases also. Those amounts were categorised as unbilled (4342). But the total outstanding amount clubs both the categories on the app, but on net banking, it doesn’t consider the unsettled bill.

Should I report this to my branch or should I wait for it to move to unbilled. also, should I pay the unsettled amount also while repaying my CC due?

Should I report this to my branch or should I wait for it to move to unbilled. also, should I pay the unsettled amount also while repaying my CC due?