Brijesh8291

KF Rookie

Hi,Just need some help

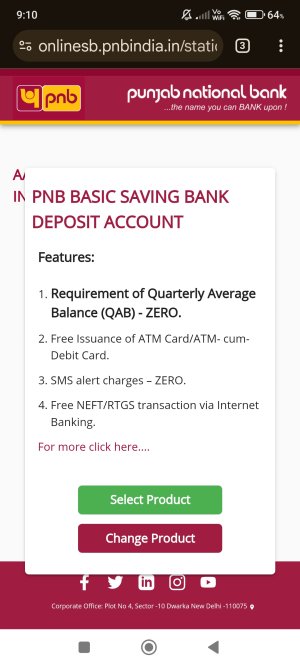

So,today just applied for the closure of my jupiter account I was using as a secondary account for my outer transaction as if for now jupyter and FI is playing dirty to maintain the MAB of Rs 5000 Now I am left with were few options

1.federal Banks zero balance account(Fedbook selfie)

2.induslnd bank zero balance account(Not good service on my side)

3.IDFC Bank future first(Not good service on my side and heard that now is we have go to the branch for account opening)

can you guys can suggest a good zero balance account

And any one holding a federal bank zero balance account holder. please guide me through it?

So,today just applied for the closure of my jupiter account I was using as a secondary account for my outer transaction as if for now jupyter and FI is playing dirty to maintain the MAB of Rs 5000 Now I am left with were few options

1.federal Banks zero balance account(Fedbook selfie)

2.induslnd bank zero balance account(Not good service on my side)

3.IDFC Bank future first(Not good service on my side and heard that now is we have go to the branch for account opening)

can you guys can suggest a good zero balance account

And any one holding a federal bank zero balance account holder. please guide me through it?