ajijul_93rahman

KF Ace

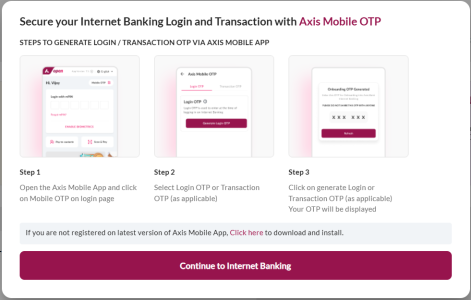

If you use Axis Internet Banking, you know how important OTPs are for login and transactions. Until now, these OTPs were sent via SMS, but Axis Bank is now introducing Mobile OTP via the Axis Mobile App for a more secure and seamless experience.

What is Axis Mobile OTP?

Axis Mobile OTP allows users to generate OTPs directly from the Axis Mobile Banking App, eliminating the need to wait for SMS-based OTPs. This is useful when you have network issues or delays in receiving OTP messages.

How to Use Axis Mobile OTP?

Benefits of Axis Mobile OTP

Coming Soon!

As per the Axis Bank website, this feature is coming soon, so keep an eye out for updates. You may need to update your Axis Mobile app once the rollout begins.What do you think?

Drop your thoughts below!