You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

civil score

- Thread starter Shivansh

- Start date

Skylar

KF Mentor

Consistently pay your bills on time to improve your CIBIL score.easy tips which helps to improve civil score and best website to check it because different websites shows different score

Skylar

KF Mentor

Directly on their website orbest website to check it because different websites shows different score

- Amazon

- Airtel

- Gpay

Kush.o7

KF Rookie

Hey Shivansh,easy tips which helps to improve civil score and best website to check it because different websites shows different score

The best way to improve your cibil score are:

1. You should not apply for multiple credit cards in a short span. For example: Don't apply 2-3 within one year.

2. Pay your credit card bill in timely manner. Suggestion~ Pay your full bill just before the due date or when the bill is made.

3. Utilize maximum 30% of your credit card limit and pay that amount in one go.

4. If you have any on paper loan try to pay an extra EMI. It will surely helps to improve your Cibil score.

Thanks,

Kush

Skylar

KF Mentor

Any experience with this?Don't apply 2-3 within one year.

Kush.o7

KF Rookie

Hello Skylar,

As you applied for multiple credit products in a short time, your enquiries increase. It shows that you heavily rely on credit. Lending institutions may assume you are a risky borrower.

Additionally, as you applied 8 cards in last 12 months, it do affect your Cibil from 785 to 781. It is minimal but the cibil is not improving.

Thanks,

Kush

As you applied for multiple credit products in a short time, your enquiries increase. It shows that you heavily rely on credit. Lending institutions may assume you are a risky borrower.

Additionally, as you applied 8 cards in last 12 months, it do affect your Cibil from 785 to 781. It is minimal but the cibil is not improving.

Thanks,

Kush

Mr Simplifier

KF Ace

If I pay my credit card bill before time... how will it impact my score ...? positive or negative?

It might sound funny but sayad negative hota hai... Is it correct..?

It might sound funny but sayad negative hota hai... Is it correct..?

Skylar

KF Mentor

This is what YouTube feeds you.It shows that you heavily rely on credit. Lending institutions may assume you are a risky borrower.

Remember

- Only thing that matters is timely payment.

- Not overspending every month.

You can cross the 30% utilization ratio but once or twice that's no big deal but if you do it every month then it's a problem.

And if you think you can use more than 30% and then make payment before the bill generates, it won't work that why as total amount spent will be reported.

I have 13 enquiries and 8 new cards in the last 12 months yet only 4 points difference, Casuse every enquiry and new card report drops 2 points but my timly payments and credit age increases every month gaining me 1 point and it gets balanced by June.

Skylar

KF Mentor

Nope, it is positive.If I pay my credit card bill before time... how will it impact my score ...? positive or negative?

It might sound funny but sayad negative hota hai... Is it correct..?

With a card that I'm not having auto debit feature, I pay them off Immediately.

Kush.o7

KF Rookie

Hello Mr Simplifier,

It you are making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower as well, which can boost your credit scores.

Thanks,

Kush

It you are making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower as well, which can boost your credit scores.

Thanks,

Kush

Skylar

KF Mentor

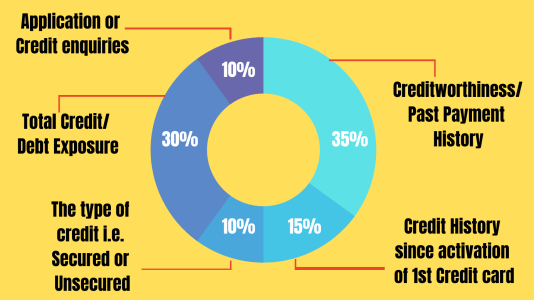

Your CIBIL score is dependent on various factors. Below are 6 steps which will help you better your score:

- Always pay your dues on time 35%

- Keep your credit balances low 30%

- Apply for new credit in moderation 10%

- Maintain a healthy credit mix of secured (such as home loan, auto loan) and unsecured loans (such as personal loan, credit cards). 10%

- Monitor your co-signed, guaranteed and joint accounts monthly

- Review your credit history frequently throughout the year

Kush.o7

KF Rookie

This is what YouTube feeds you.

Remember

- Only thing that matters is timely payment.

- Not overspending every month.

You can cross the 30% utilization ratio but once or twice that's no big deal but if you do it every month then it's a problem.

And if you think you can use more than 30% and then make payment before the bill generates, it won't work that why as total amount spent will be reported.

I have 13 enquiries and 8 new cards in the last 12 months yet only 4 points difference, Casuse every enquiry and new card report drops 2 points but my timly payments and credit age increases every month gaining me 1 point and it gets balanced by June.

[/QUOTE

Remember

- Only thing that matters is timely payment.

- Not overspending every month.

You can cross the 30% utilization ratio but once or twice that's no big deal but if you do it every month then it's a problem.

And if you think you can use more than 30% and then make payment before the bill generates, it won't work that why as total amount spent will be reported.

I have 13 enquiries and 8 new cards in the last 12 months yet only 4 points difference, Casuse every enquiry and new card report drops 2 points but my timly payments and credit age increases every month gaining me 1 point and it gets balanced by June.

[/QUOTE

Kush.o7

KF Rookie

Hello Skylar,

I do agree that your Cibil impacted with 4 points only. This is a minor effect and should not be too worrisome unless your previous score was borderline 700 and this drop takes you under 700, generally preferred cutoff for approval by most banks. Multiple credit cards in short span do impact Cibil even though it is minimal it will not improve your Cibil. But in a longer run it will gradually improve only if you pay the bills in timely manner.

Thanks,

Kush

I do agree that your Cibil impacted with 4 points only. This is a minor effect and should not be too worrisome unless your previous score was borderline 700 and this drop takes you under 700, generally preferred cutoff for approval by most banks. Multiple credit cards in short span do impact Cibil even though it is minimal it will not improve your Cibil. But in a longer run it will gradually improve only if you pay the bills in timely manner.

Thanks,

Kush

Skylar

KF Mentor

My score never dropped below 781This is a minor effect and should not be too worrisome unless your previous score was borderline 700 and this drop takes you under 700, generally preferred cutoff for approval by most banks. Multiple credit cards in short span do impact Cibil even though it is minimal it will not improve your Cibil. But in a longer run it will gradually improve only if you pay the bills in timely manner.

Kush.o7

KF Rookie

I was just taking an example of 700.My score never dropped below 781

Skylar

KF Mentor

750 is new cutoff, only seen RBL and Indusland consider 700 and below.700, generally preferred cutoff for approval by most banks.

Similar threads

- Replies

- 14

- Views

- 403

- Replies

- 3

- Views

- 101