The ICICI Coral Credit Card from ICICI Bank is a nice offering that brings exclusive rewards and benefits in the realms of dining, entertainment, and travel. The card, available in three variants (Visa, Mastercard, and AmEx), allows you the flexibility to choose the one that suits you best. With a reward rate of up to 2 points for every Rs. 100 spent, redeemable across various categories, the Coral credit card ensures you earn as you spend. Additionally, the card presents an opportunity to get up to 10,000 bonus Reward Points annually through its milestone program.

Key Features & Benefits of ICICI Coral Credit Card

Annual Fee:

Movie & Dining:

The ICICI Coral Credit Card stands out as a well-rounded choice, particularly for individuals who enjoy dining out and watching movies. Discounts on movie tickets and dining bills, combined with the comprehensive rewards program, make it a valuable companion for those with social and entertainment-focused lifestyles. The milestone benefits add an extra layer of incentive, rewarding consistent card usage. The travel perks, including lounge access, further enhance its appeal. The card's annual fee is reasonable, and the renewal fee can be waived, making it an accessible option for a broad audience.

In summary, the ICICI Coral Credit Card emerges as a practical and rewarding choice for those seeking a balance of lifestyle benefits, travel perks, and cost-effectiveness in a credit card.

Key Features & Benefits of ICICI Coral Credit Card

Annual Fee:

- Joining Fee: Rs. 500 + GST

- Renewal Fee: Rs. 500 + GST

- Movies

- Dining

Movie & Dining:

- 25% discount up to Rs. 100 on BookMyShow movie ticket bookings.

- Up to 15% discount on dining.

- 1 Reward Point per Rs. 100 on utilities & insurance spends.

- 2 Reward Points per Rs. 100 on other expenditures.

- Points redeemable against various categories or as cashback at a rate of 1 Reward Point = Re. 0.25.

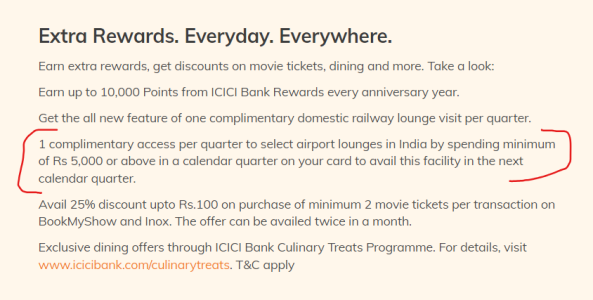

- Complimentary Airport and Railway Lounge get to in each quarter of a year.

- 1 Domestic Lounge Get to in Each Quarter (4 Each Year).

- 2,000 Reward points on spending Rs. 2 lakh annually.

- 1,000 bonus Reward Points on achieving Rs. 1,00,000 target within an anniversary year.

- Fuel surcharge waiver of 1% at all HPCL petrol stations for transactions up to Rs. 4,000.

- Renewal fee waiver on spending Rs. 1.5 lakh or more in the previous year.

- Primary cardholder age: 23 years or more.

- Supplementary cardholder’s age: 18 years or more.

- Net income as per ITR for the primary cardholder: Rs. 5 lakh.

- Apply online or visit the nearest ICICI Bank branch with the necessary documents (proof of address, identity, and income).

The ICICI Coral Credit Card stands out as a well-rounded choice, particularly for individuals who enjoy dining out and watching movies. Discounts on movie tickets and dining bills, combined with the comprehensive rewards program, make it a valuable companion for those with social and entertainment-focused lifestyles. The milestone benefits add an extra layer of incentive, rewarding consistent card usage. The travel perks, including lounge access, further enhance its appeal. The card's annual fee is reasonable, and the renewal fee can be waived, making it an accessible option for a broad audience.

In summary, the ICICI Coral Credit Card emerges as a practical and rewarding choice for those seeking a balance of lifestyle benefits, travel perks, and cost-effectiveness in a credit card.